geothermal tax credit form

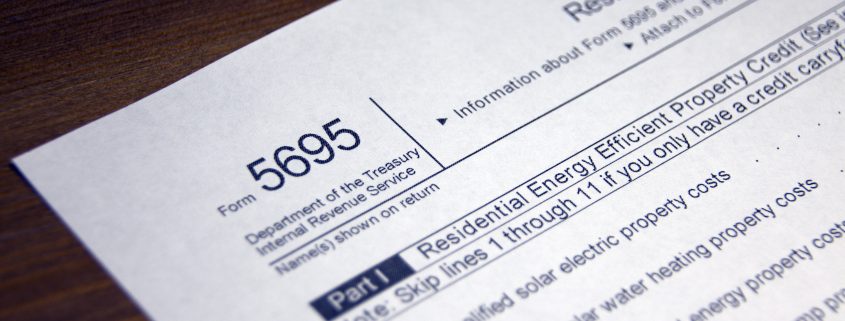

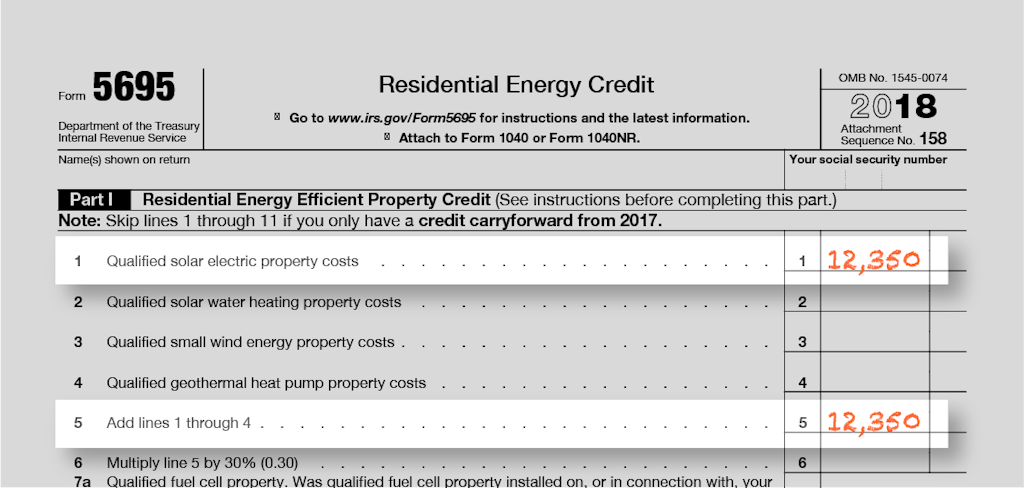

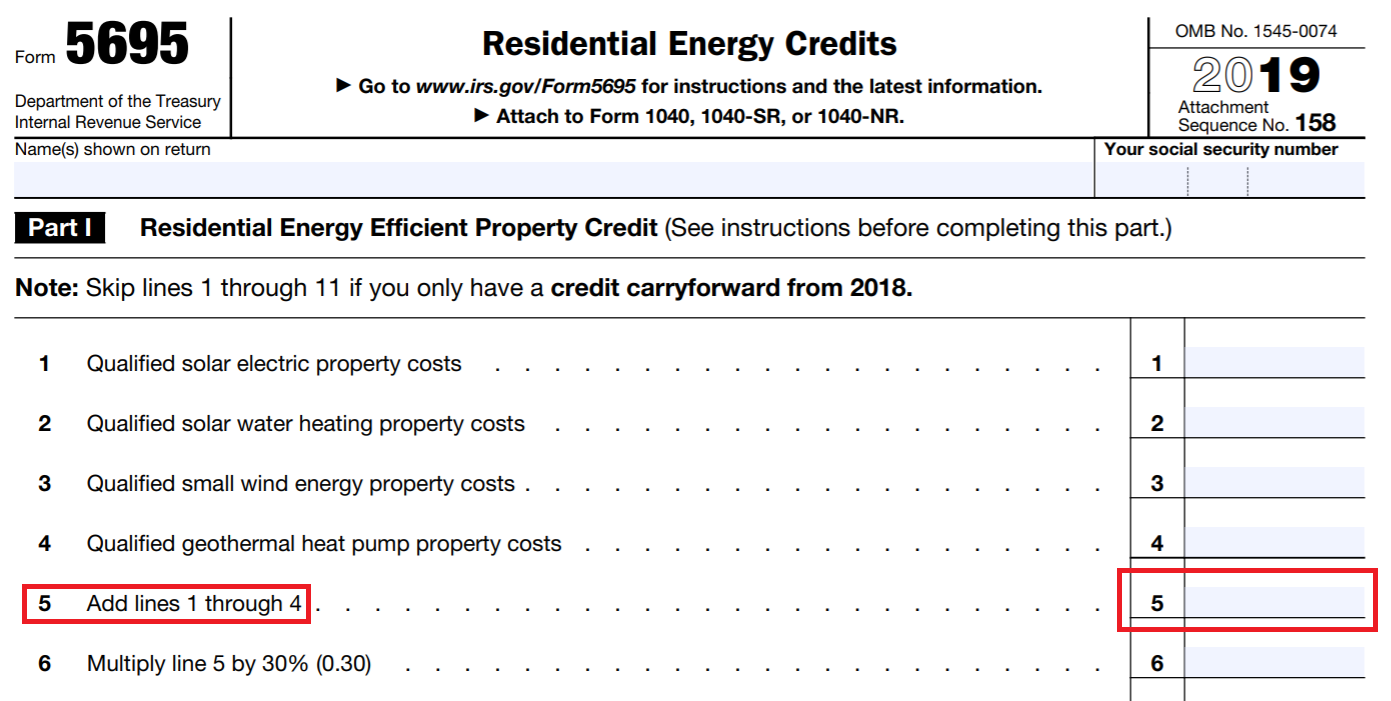

The Geothermal Tax Credit filed through form 5695 covers expenses associated with the installation of ground source heat pumps. Residential Energy-Efficient Property Credit.

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar Com

You may not claim this credit after Tax Year.

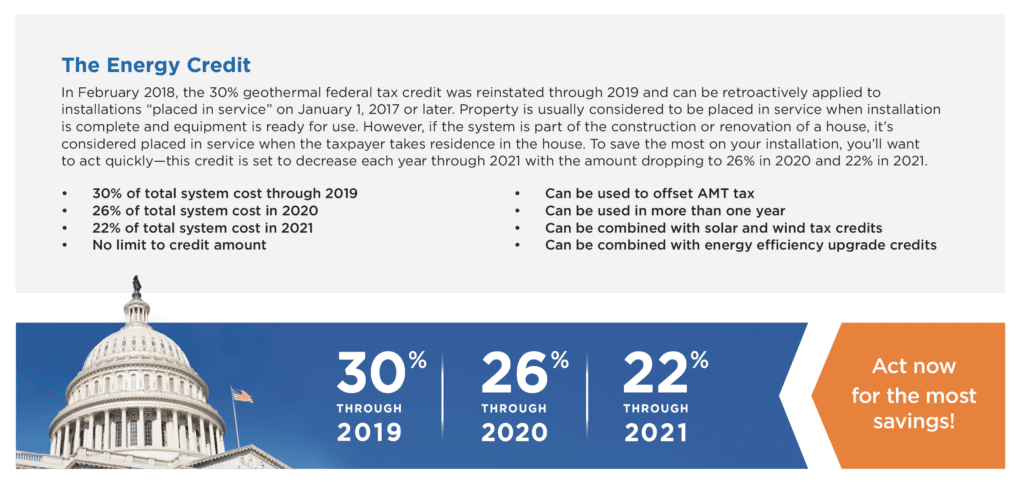

. Unless amended the tax credit will extend until 31 December 2016. The Federal Investment Tax Credit applies to both solar and geothermal. However the percentage covered by the ITC will decrease to.

This tax credit allows you to deduct 26 percent of the cost of installation from your federal taxes. Login to TurboTax Online. If you are claiming the credit in a carryforward year begin with this line.

The 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032. If you checked the No box you cannot claim the nonbusiness energy property credit. Homeowners who install geothermal can get the tax credit.

Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and. Taxpayers filing a claim for the Geothermal Tax Credit were. This geothermal heat pump tax credit was created by the Energy Improvement and Extension Act of 2008 HR.

Click My Account top. Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file. A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was.

The tax credit currently stands at 26 percent throughout 2021 and 2022 before decreasing to 22 percent in 2023. The credit for solar energy or small hydropower. This credit was repealed by the 2021 Montana State Legislature.

The IRS issues federal tax credits themselves. The Geothermal Tax Credit was available for installations beginning on or after January 1 2017 through December 31 2018. However if the system is part of the construction or renovation of a house its considered placed in service when the taxpayer takes residence in the house.

Therefore the signNow web application is a must-have for completing and signing fillable online understand the geothermal tax credit on the go. In 2022 the federal tax incentives known as the Investment Tax Credit ITC rose to 30 of a Dandelion geothermal system. This includes labor onsite preparation equipment.

Renewable energy tax credits for fuel cells small wind turbines. In a matter of seconds receive an electronic. Heres how to fill out form 5695 using TurboTax.

In December 2020 the tax credit for. When submitting a tax return file Form 5695 under. Geothermal System Credit Form ENRG-A December 30 2021.

A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032. Unused credits may be carried forward for up to 10 years. The incentive will be lowered to 26 for systems that are installed.

Geothermal Tax Credit Explanation. To enter your Residential Energy Credits Form 5695 into TurboTax Online. Use Form 5695 to figure and take your.

Claiming a geothermal tax credit is as simple as filing your taxes next year. The incentive will be lowered to 26 for systems that. The tax credits for residential renewable energy products are now available through December 31 2023.

Do not complete Part II.

Filing For Residential Energy Tax Credits What You Need To Know

Here S How To Claim The Solar Tax Credits On Your Tax Return Southern Current

State Of Hawaiʻi And Federal Incentives Hawai I State Energy Office

Indonesia Vat Everything You Need To Know About Value Added Tax

What Federal Tax Incentives Are There For Geothermal Heat Pumps

300 Federal Tax Credits For Air Conditioners And Heat Pumps Symbiont Air Conditioning

Experts Explain 2022 Home Energy Federal Tax Incentives

Tax Forms Irs Tax Forms Bankrate Com

Printable 2021 Montana Form Enrg A Geothermal System Credit

Learn About The Incentives Of Geothermal Comfortworks Inc

Solar Tax Credits Sun Powered Yachts

How To File Irs Form 5695 To Claim Your Renewable Energy Credits

Irs Deals Major Blow To Geothermal Market Air Ideal

How Do I Claim The Solar Tax Credit Itc Form 5695 Instructions

How To Claim The Solar Investment Tax Credit Ysg Solar Ysg Solar

Form 5695 Claiming Residential Energy Credits Jackson Hewitt

Going Green This St Patrick S Day With Renewed Residential Energy Tax Credits Don T Mess With Taxes

Save Money With The Federal Solar Tax Credit And Other Renewable Energy Incentives